federal income tax canada

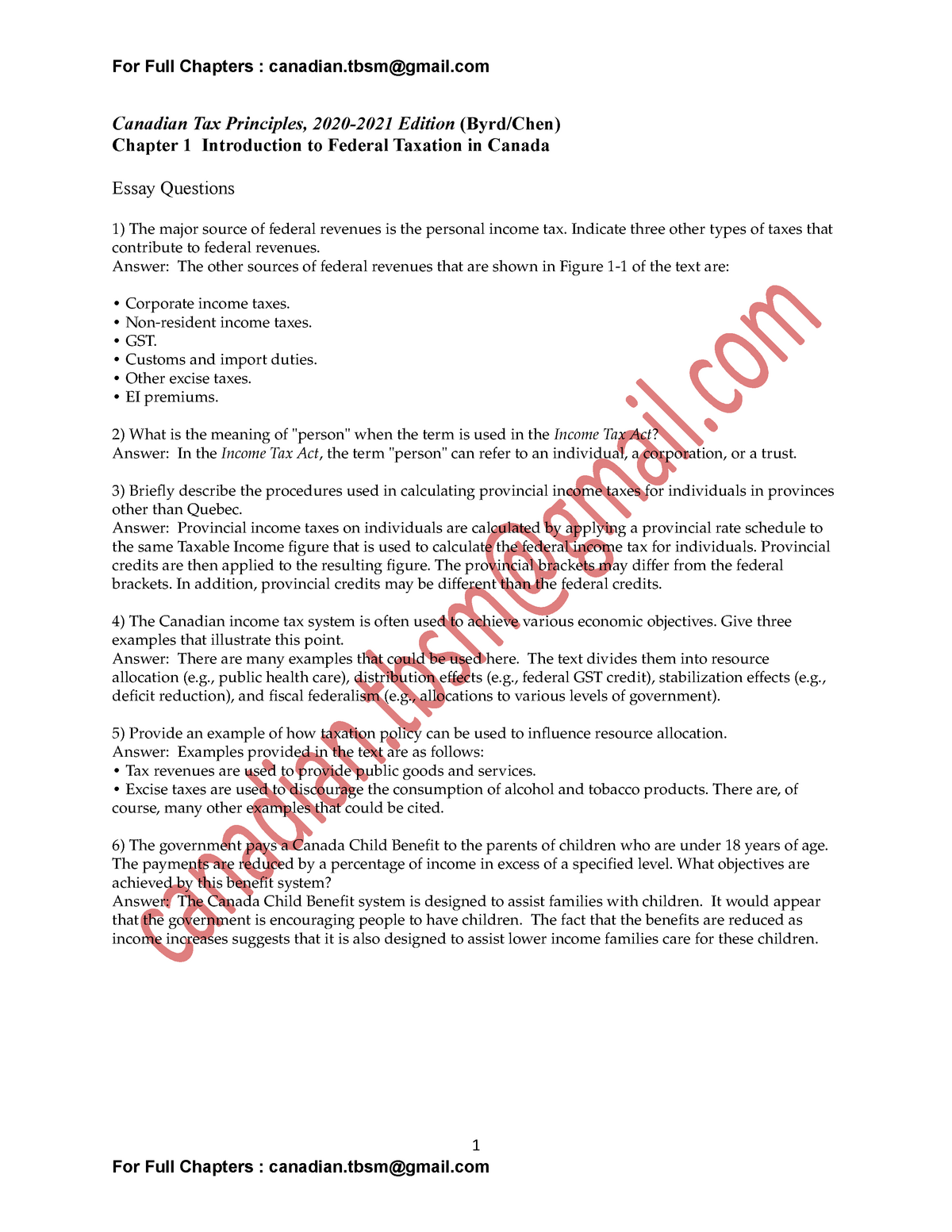

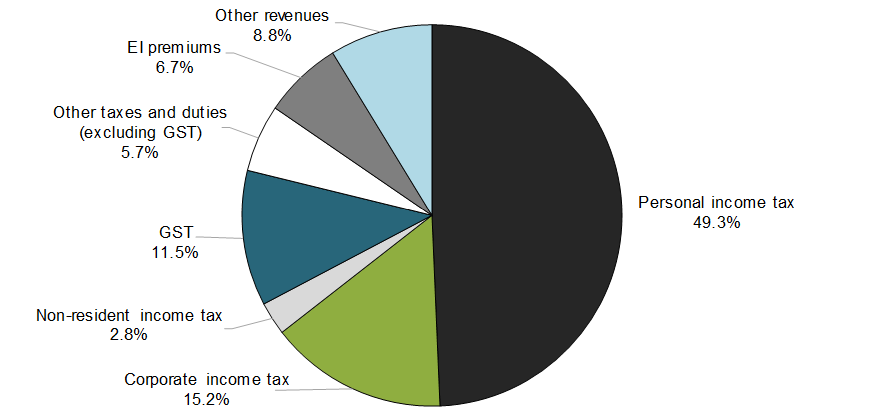

In Canada income tax is charged by the Canadian government on income you earn and is the main source of revenue for the government. For 2019 and later tax years you can find the federal tax rates on your income tax and benefit return.

Canada S Corporations Have Already Earned Enough To Pay Their Income Taxes For The Year Huffpost Business

You will be required to pay both federal and.

. 22 on taxable income between 43954. Today approximately one half of the federal government s revenue is derived from personal income tax a significant increase from 26 per cent in 1918. There are seven federal tax brackets for the 2022 tax year.

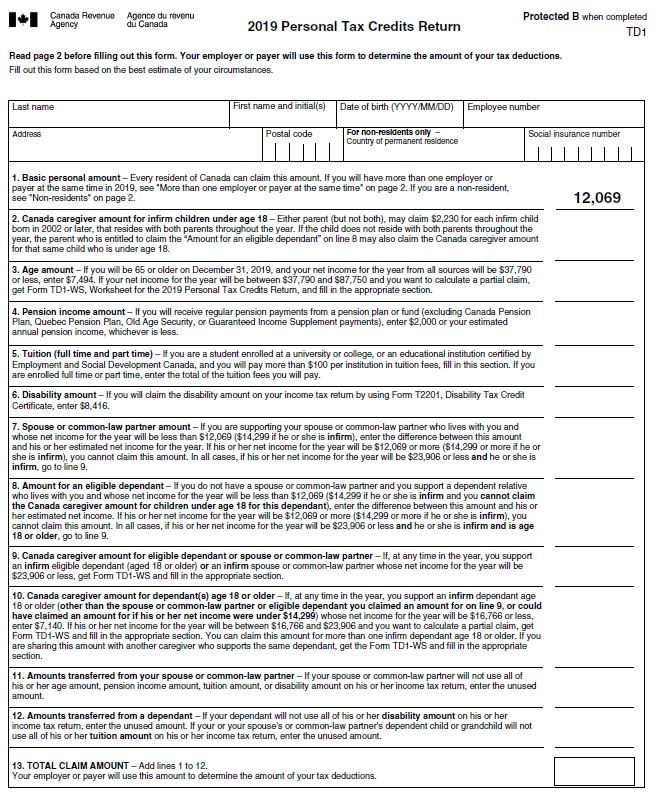

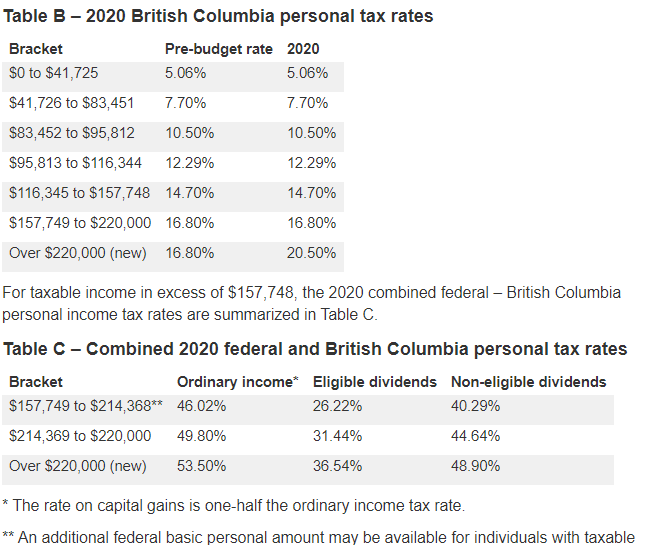

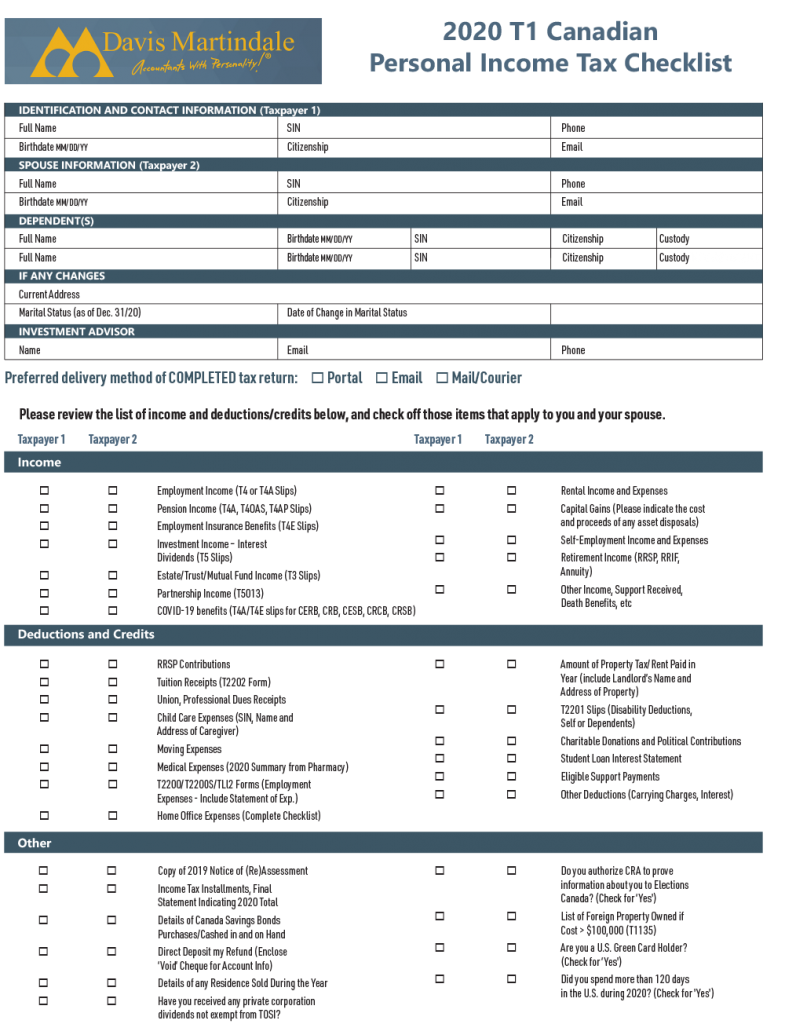

Income tax GSTHST Payroll Business number Savings and pension plans. Quebec has its own personal tax system which requires a separate calculation of taxable Income. You can find the provincial or territorial tax rates on Form 428 for the respective.

Total federal income taxes might be. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. If your taxable income is less than the 50197 threshold you pay.

Recognising that Quebec collects its own tax federal income tax is reduced by. Personal income taxes are a crucial part of the governments revenue. In 1938 23 per cent of.

TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and provincial taxes. Changes to taxes and benefits. 15 on the first 49020 of taxable.

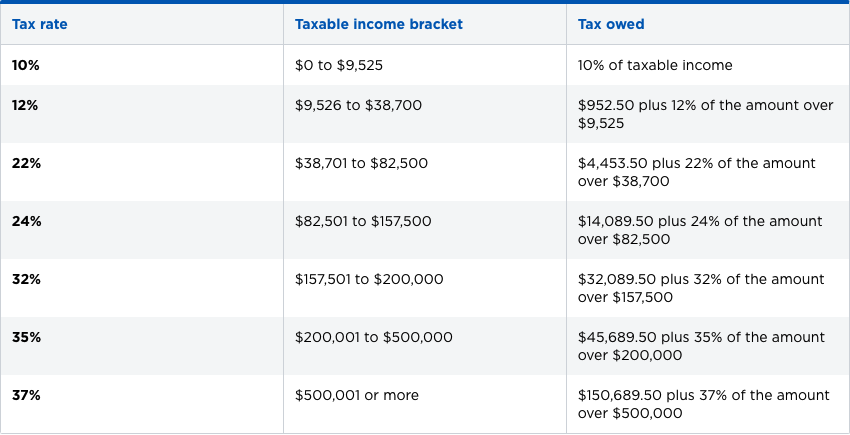

Your bracket depends on your taxable income and filing status. How Canadas personal income tax brackets work How much federal tax do I have to pay based on my income. 10 12 22 24 32 35 and 37.

For heads of household the 2023 standard deduction will be 20800. Federal Tax Bracket Rates for 2021. It is increasing by 900 to 13850 for single taxpayers and by 1800 for married couples to 27700.

File taxes and get tax information for individuals businesses charities and trusts. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. These are the rates for.

File income tax get the income tax and benefit package and check the status of your tax refund. The rates for the year 2014 are as follows. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. 350634 42184 at a. The personal income tax system in Canada is a progressive tax system.

Find out your tax refund or taxes owed plus federal and provincial tax rates. To pay off debt the government generally needs to increase income which means higher taxes. The federal tax rate varies between 15-29 based on income.

15 on taxable income of up to 43953. Find out about Canada Revenue Agencys new benefits and other changes that support Canadians during the COVID-19 pandemic. 960390 49020 at a 15 tax rate then 10980 at 205 a tax rate Total provincial income taxes would be.

58 rows The federal government charges you 15 on the first 49020 you made minus the federal exemption of 13808 and then 205 on the remaining amount.

2020 Canadian Personal Income Tax Checklist Davis Martindale

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

Solutions And Test Bank For Byrd Chen S Canadian Tax Principles 2020 2021 Edition Volumes I And Studocu

Request For Voluntary Federal Income Tax Deductions Fill Online Printable Fillable Blank Pdffiller

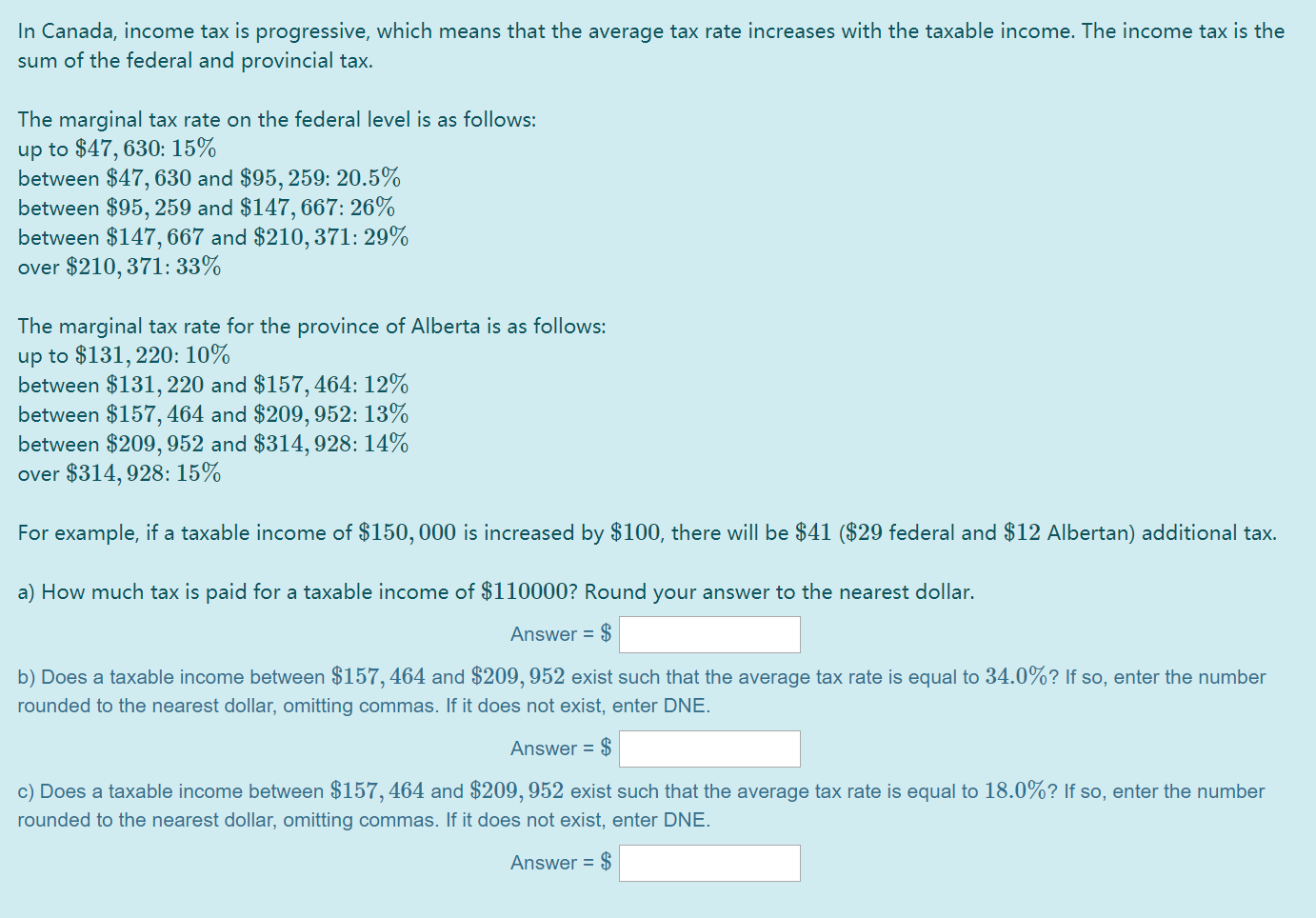

Solved In Canada Income Tax Is Progressive Which Means Chegg Com

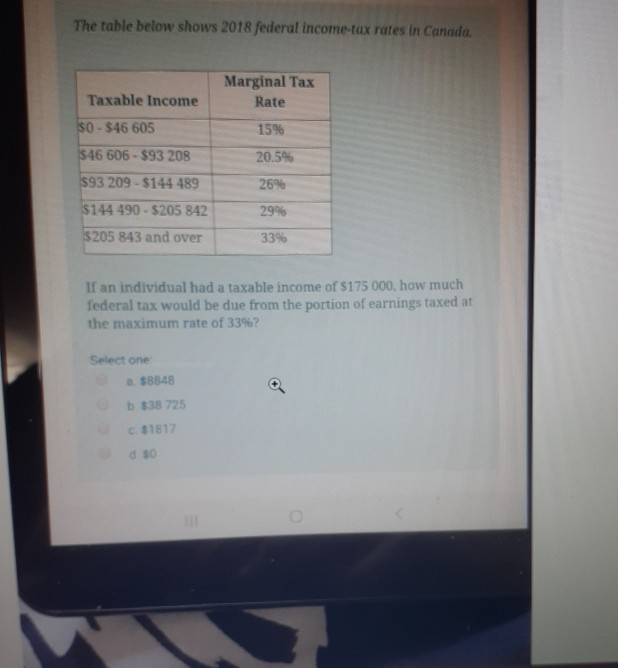

Solved The Table Below Shows 2018 Federal Income Tax Rates Chegg Com

Federal Income Tax Brackets For Tax Years 2022 And 2023 Smartasset

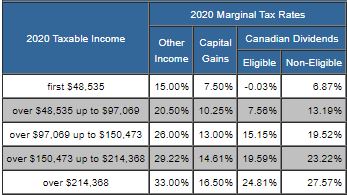

Taxtips Ca Federal 2019 2020 Income Tax Rates

Federal Corporate Income Tax Revenues Actual And As A Percentage Of Download Table

Northern Trust Wealth Management Asset Management Asset Servicing

How Do Federal Income Tax Rates Work Tax Policy Center

Personal Income Tax Brackets Ontario 2021 Md Tax

Bundle 2021 2022 Introduction To By Nathalie Johnstone 9781773791555 Redshelf

Us Vs Canada Tax Revenues Breakdown Tax Policy Center

Federal Income Tax Brackets Brilliant Tax

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Table How Your Federal Income Tax Will Change Under Trudeau S 2016 Tax Plan R Canada